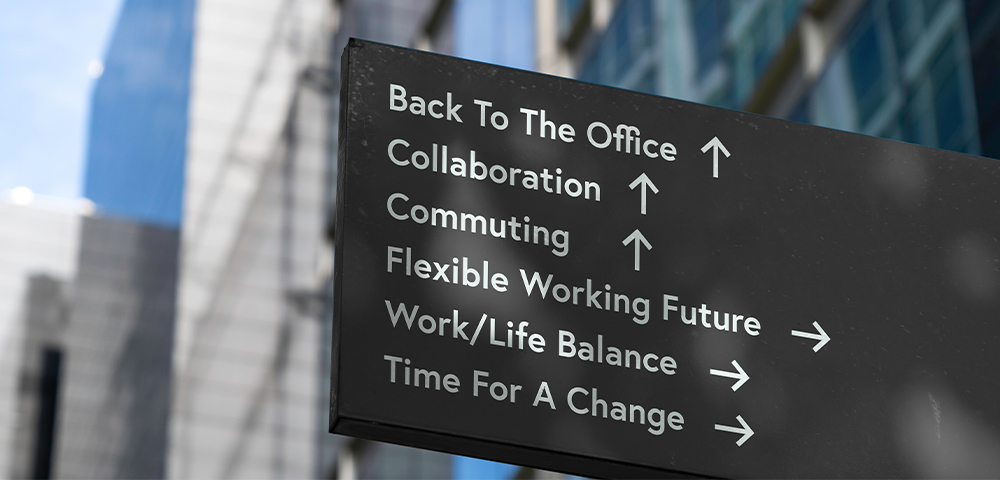

After workers voluntarily quit their jobs in 2021, business owners are working harder than ever to recruit and retain top talent to keep businesses running. Learn how to navigate the new workplace landscape from leading experts.

The retail potato market remains hot, according to a recent news release from Potatoes USA, based on its annual sales and utilization study on potato consumption in 2021.

See how our teams are financing affordable seniors housing that restores dignity, independence and strengthens communities impacting some of our most beloved citizens.

Low-income renters are desperate to find affordable rental units. It's an uphill battle, but experts believe the landscape is rich with opportunity for practical innovation.

The demand for affordable housing across the U.S. remains great, and so does the dedication from the affordable housing finance industry to meet the need. Affordable housing investors have both capital and a mandate to place it, but the complexity and cost of deals has presented challenges to developers and investors alike.

After two turbulent pandemic years, leaders in the commercial real estate (CRE) industry are ready to look ahead. Economic growth accelerated in 2021, but it brought with it inflation and risk. Some CRE subsectors are faring better in a marketplace that is flooded with capital. And, the industry as a whole is reckoning with issues such as digital transformation, environmental, social and governance (ESG) mandates and the competitive hiring market.

Utilizing modern, well-maintained equipment is imperative for food manufacturers to safely increase productivity, manage operational costs and remain competitive in their market. Keeping up with the technological advances in food manufacturing equipment can be a costly challenge for companies who plan to purchase the equipment with cash.

Key understands the climate challenges facing our planet and is committed to both further reducing our environmental footprint and continuing to enable our stakeholders in their efforts to do the same.

As we begin 2022, our teams are prepared to work together toward your continued success from day one. We appreciate your enduring collaboration.

KeyBanc Capital Markets experts Jeff Johnston and J.R. Doolos shared their 2022 M&A market insights with Crain's Cleveland Business. Learn how and why they believe future M&A growth will be tied to specific industries in this January 17, 2022 article.

KeyBanc Capital Markets® Managing Director Sam Adams has been recognized by The Bond Buyer as a 2021 Rising Star. Congratulations Sam.

KeyBanc Capital Markets® is the 2021 winner of PFR's Renewables Lead Arranger of the Year, carving out a niche as a top name in renewables investment banking since first starting to invest in the space in 2007. Since 2010, the group has financed over $15 billion of renewables transactions.