An estate plan ensures your values, wishes and legacy are preserved and passed on. It also limits litigation, taxes and expenses for your family and heirs. Make time for estate planning today. Learn more about what’s important and how to start.

“Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.” – Benjamin Franklin

There are trust vehicles available today that can help you prepare for the future and take advantage of planning opportunities. These include dynasty trusts, spousal lifetime access trusts, and self-settled domestic asset trusts.

Market volatility continues to be a major headline of 2020, due to economic turmoil caused by the Coronavirus pandemic. With stimulus negotiations between Congress and White House ongoing, economic volatility continues to be a theme of 2020 investment strategies.

Investors and consumers alike are shifting their focus to various different industries with a focus on speed, flexibility, health and safety—but are these areas sustainable over the long term?

It’s undeniable that 2020 has been a year of unprecedented surprises, and this year’s election promises to present even more uncertainty given the stakes.

You say you want a revolution, we better get on right away, well you get on your feet and get out in the street and update that durable power of attorney (POA).

All right, so the words of John Lennon’s 1971 ballad were slightly different, but they stress the urgency of the situation.

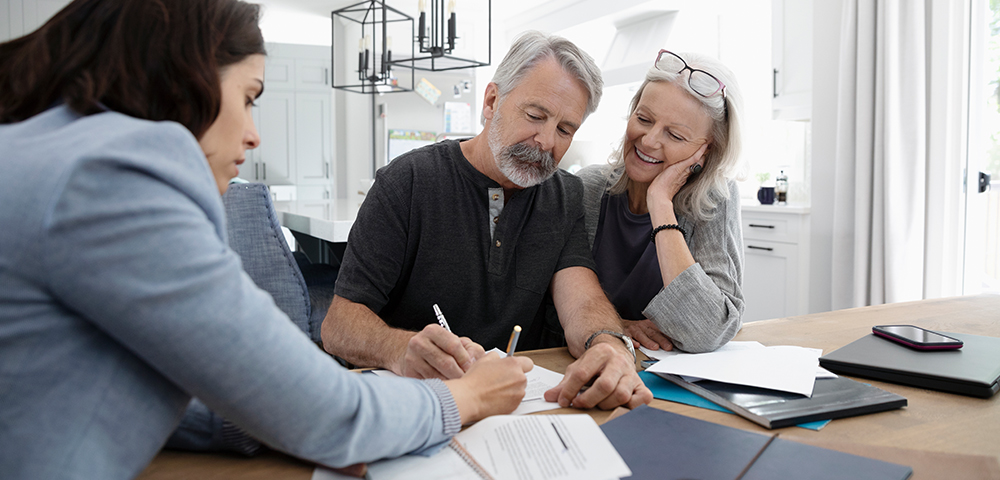

National Director of Key Family Wealth Legacy Planning Services Anne Marie Levin, and Jeff Wortley, Key Wealth Institute’s editorial chairman, discuss the importance of wills to estate planning.

Find out how to control when and how your heirs can receive the inheritance you plan to leave. Individual needs of grantors and heirs vary. So while it’s natural to think of giving each child an equal inheritance, doing so doesn’t always fit with the children’s needs or your personal objectives and values.

Find out the basics on trusts, beneficiaries and how the different types of trusts can manage a family's needs.

If you do not have a will when you pass away, your state’s court system will decide who your heirs are and how much each receives.

Key Private Bank National Director of Wealth Services, Karen Arth talks about family dynamics in estate planning on the podcast series, “Money Life with Chuck Jaffe.”

The biggest misconception people have about estate planning is that "they are not that old, and can do it later," say almost half (49%) of advisors in the Key Private Bank Advisor Poll on estate planning.

Key Private Bank’s Quarterly Advisor Poll surveyed more than 120 client-facing advisors, examining their experiences working with clients on estate planning.