Multifamily Rate Sheet

Subscribe to our rates

KeyBank Real Estate Capital experts can help you understand market changes and get deals done.

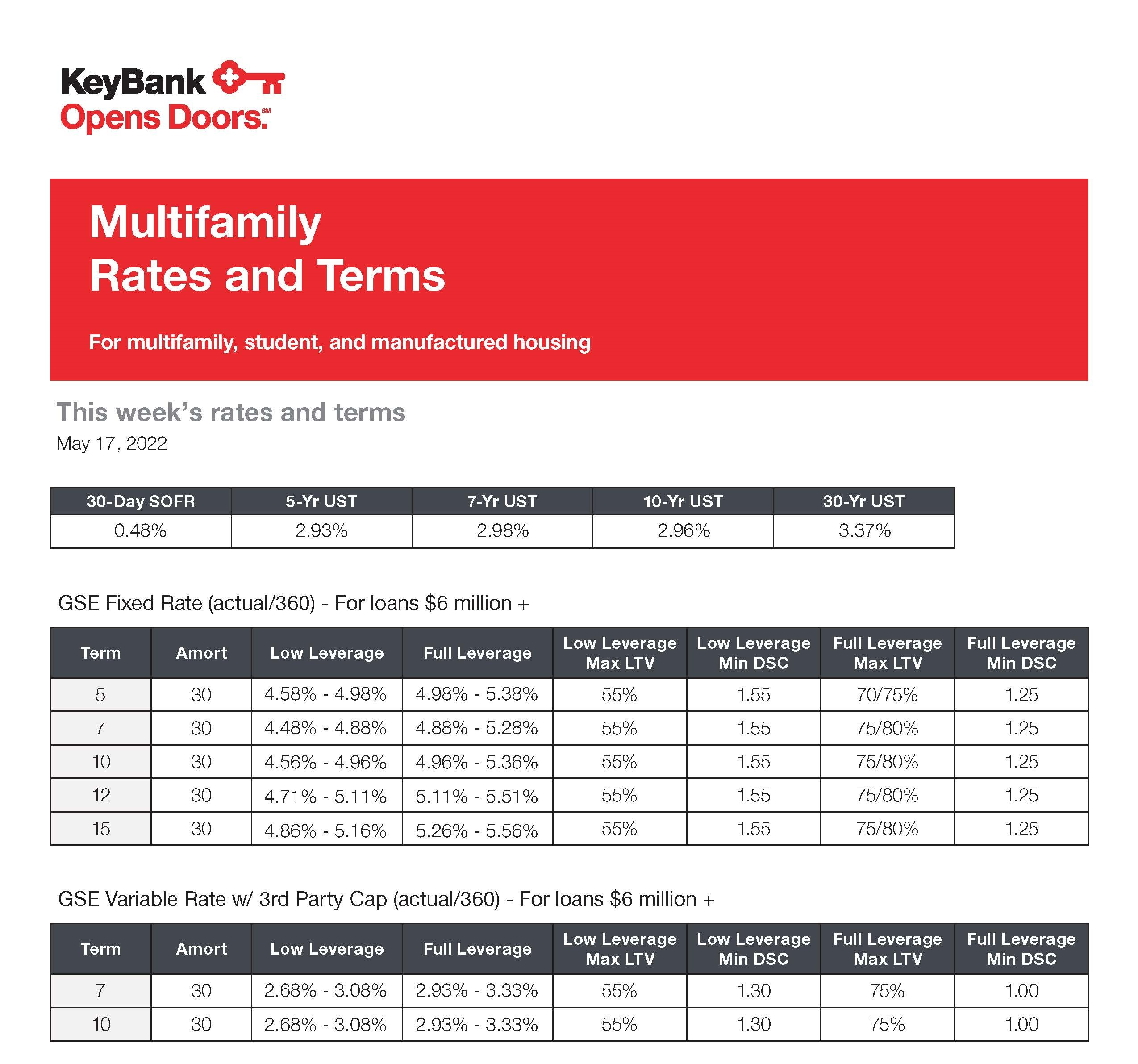

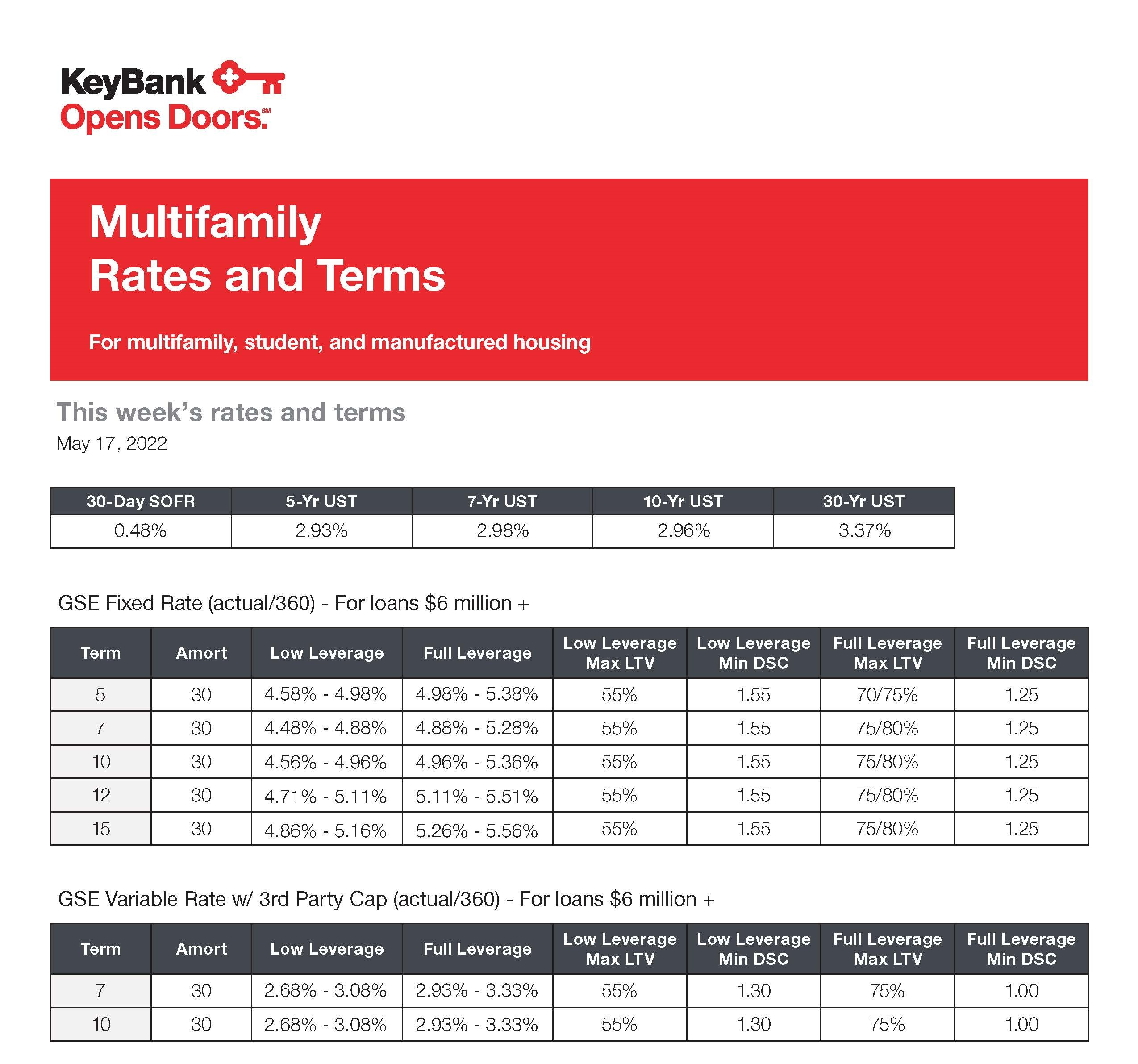

This week's rate sheet:

Subscribe to our rates

KeyBank Real Estate Capital experts can help you understand market changes and get deals done.

Commodore Place Apartments

The rehabilitation of the Commodore Apartments was recently honored by the Advisory Council on Historic Preservation (ACHP) and the U.S. Department of Housing and Urban Development (HUD) with the 2023 ACHP/HUD Secretary’s Award for Excellence in Historic Preservation.

This annual award recognizes a single project that has successfully advanced the goals of historic preservation, while at the same time providing affordable housing for low- and moderate-income families and individuals.

In 2018, KeyBank Community Development Lending and Investment (CDLI) provided a total of $39.4 million in financing for the redevelopment and preservation of Commodore Place Apartments in Cleveland, OH. Specifically, KeyBank provided a $16.6 million LIHTC equity investment, an $11.6 million construction loan and an $11.1 million non-recourse, FHA 221(d)(4) first mortgage loan.

The 12-story, high-rise building was originally constructed in 1924 as a hotel and later converted into apartments in 1964, with renovations in 2008 and 2010. The 198-unit multifamily apartment complex features 23 studio, 142 one-bedroom and 33 two-bedroom units. A project-based Section 8 HAP contract provides rental assistance to 144 units for tenants earning between 30% and 60% AMI.

“Our partnership with The Community Builders, Inc. and University Circle demonstrates our commitment to creating and preserving affordable housing where we live and work,” said Rob Likes, president of KeyBank’s CDLI team.

“This redevelopment preserves and improves nearly 200 quality apartments for families of all incomes at the heart of University Circle. The Community Builders is thrilled to work with KeyBank and our local partners to preserve and enhance the historic Commodore Apartments and provide connections to opportunities in this thriving neighborhood,” said Terri Hamilton Brown, regional vice president of development, The Community Builders Midwest.

“The historic Commodore building is an important part of University Circle’s past, present, and future. University Circle Inc. is pleased to see The Community Builders Inc. and KeyBank Community Development Lending and Investment make a significant investment to preserve and enhance the building for the residents and retailers and add to the spectrum of housing choices that ensure University Circle remains an economically integrated and vibrant community,” said Chris Ronayne, president of University Circle Inc.

The building will be substantially rehabilitated, including replacement of the roof, elevator modernization, new fire alarm system installation, replacement of domestic water supply and waste plumbing, accessibility upgrades, and in-unit renovations, including upgrading the kitchens, baths, flooring and interior doors, among other items.

The financing was made possible by Ohio Housing Finance Agency, the City of Cleveland and The Community Builders.

Letsche School

Construction Loan & LIHTC

KeyBank on Tuesday announced $21 million in financing for the Letsche School Development in Pittsburgh.

KeyBank Community Development Lending and Investment provided a $9.8 million construction loan and $11.8 million in low-income housing tax credit equity for the construction of the affordable multifamily property.

The project includes the reuse of the historic former Letsche School and new construction of four townhomes on two adjacent vacant parcels. It will create 46 mixed-income units and a community space for families and individuals earning no more than 60% of the area median income, of which 25 units will be subsidized by a Section 8 Housing Assistant Payment Contract and seven units will remain at market rate.

Amenities will include a community room, courtyard and picnic area, laundry room, playground, and elevator. An on-site resident service coordinator will develop educational, recreational, and cultural programming and ensure that residents are linked to the specific supportive services they need to continue to live independently. These services include rent assistance, mental and behavioral health, workforce training, family empowerment initiatives and education, health and wellness, youth enrichment and community building.

The project sponsor is Beacon Communities LLC, the Boston-based developer, owner, and manager of multifamily real estate properties, including affordable housing.

It received permanent financing from the Pennsylvania Housing Finance Authority and aligns with the Hill District Community Development Corp. Master Plan to revitalize existing structures and provide affordable housing within mixed-income developments in the Greater Hill District of Pittsburgh.

Community View Apartments

KeyBank Community Development Lending and Investment (CDLI) provided a $9 million construction loan and $12 million in Low-Income Housing Tax Credit (LIHTC) equity for the construction of an affordable senior housing property in Morrisville, New York.

Community View Apartments will consist of 61 units for individuals aged 55 and older and earning no more than 30%, 40%, 50% and 60% of the area median income (AMI). Of the 61 units, 20 will be covered by the Empire State Supportive Housing Initiative (ESSHI) and will target individuals who are at risk of homelessness, formerly homeless, enrolled in Medicaid, and have either a chronic condition, physical disability, or require assistance with one or more instrumental activities of daily living.

The project sponsor is Christopher Community, Inc. (“CCI”), a nonprofit developer and manager of affordable housing based in Syracuse. The project will enter into a housing services agreement with Crouse Community Center, a skilled nursing facility affiliated with Crouse Hospital, which will offer the ESSHI units with comprehensive supportive services. An on-site case manager will be provided to develop individual service plans to cater to each tenant's specific needs as well as help with housing subsidy recertifications, obtaining health insurance, SSI/SSD benefits, SNAP, and utility assistance. The case manager will also assist tenants in applying for educational programs and providing access to computers and the internet.

In addition, the property will have a medical case manager to help tenants schedule doctor’s appointments, coordinate transportation, track health conditions, and provide guidance for healthy living initiatives and social activities. The case managers will coordinate services with offsite local providers for substance abuse counseling, mental health support, vocational training, additional medical case management, legal, and educational services.

The project is in a quiet, residential setting directly adjacent to the Crouse Community campus. In addition, Crouse Community Center has begun construction of an adult daycare facility adjacent to Community View Apartments, which will operate Adult Daycare Healthcare (ADHC) programs that will allow registrants to utilize the services of Crouse Community Center’s existing Outpatient Therapy and physician services from the nearby Community Memorial Hospital’s Primary Care Physician Office.

"As we embark on the construction of Community View Apartments, we are grateful for the generous support of KeyBank. Their $21 million financing, comprising a construction loan and Low-Income Housing Tax Credit equity, reinforces our commitment to providing affordable senior housing in Morrisville, New York,” said Justin Rudgick, President & CEO of Christopher Community, Inc. “With a focus on meeting the diverse needs of our residents, including seniors at risk of homelessness, and unstably housed in our community, we are proud to collaborate with Crouse Community Center, state agencies and local service providers to offer comprehensive supportive services. Together, we are building a vibrant community where individuals aged 55 and older can thrive and access vital resources for a fulfilling life."

"Community View Apartments is a project that is representative of what we want to invest in, because it is community-based," said Kate de la Garza, senior relationship manager with KeyBank Community Development Lending. "Christopher Community’s partnership and collaboration with other agencies and providers is reflective of how we can serve the needs of our most vulnerable neighbors."

John Paul Vachon and Kate de la Garza of KeyBank CDLI structured the financing.

2111 Firestone

KeyBank Community Development Lending and Investment (CDLI) provided $46.4 million for the construction of new permanent supportive housing in Los Angeles, California, which has the nation’s largest homeless population. The sponsor of the project is The Prime Company, a giving focused, vertically integrated multi-family development firm that designs, builds, and manages urban properties across the nation.

KeyBank CDLI provided $19.7 million in federal and state LIHTC equity, a $21.4 million construction loan, and a $5.3 million permanent loan to finance the new construction of 2111 Firestone, a six-story complex of one- and two-bedroom apartments designed to serve families and individuals exiting homelessness.

Of the 85 units, 42 units will be set aside for individuals exiting homelessness and earning no more than 30% of the Area Median Income (AMI). Forty-one units will be restricted to households earning no more than 50% of AMI. There will be two manager units.

The Prime Company, Domus Development, and Kingdom Development will build the 85-unit complex at 2111 Firestone Blvd. in unincorporated Florence-Graham, north of Watts. KeyBanc Capital Markets Group (KBCM) also sold $20.7 million of tax-exempt bonds through a public offering, the proceeds of which will be used to support financing of the project.

Supportive services will be available to all residents to help them stabilize and enhance their overall well-being. These services include intensive case management, mental health services, addiction/recovery services, employment and/or benefits advocacy, and assistance in strengthening independent living skills and building a more comprehensive natural social support system.

The lead service provider, Housing Works (HW), will offer intensive case management using a housing first, trauma-informed approach to all tenants in the building.

Margaret Wagner Senior Apartments

KeyBank Community Development Lending and Investment (CDLI) provided $9.9 million in low-income housing tax credit (LIHTC) equity to finance the conversion of the Margaret Wagner Senior Apartments in Cleveland Heights, Ohio to 80 low-income housing senior units (62+). This development will create 20 new apartments through the adaptive re-use of the first floor of Margaret Wagner House and preserve 60 apartments on the upper floors.

Built in 1960 as a nursing home by the Benjamin Rose Institute on Aging, the facility offers HUD 202 PRAC subsidy for 100% of its units. In addition to creating 20 new one-bedroom units, the project will renovate existing units with updated kitchens and bathrooms, improved accessibility, central air conditioning, elevator modernization, new roofing, and site improvements.

The project’s total cost is $18.7 million. Other financing sources include a HUD 202 Capital Advance, Cuyahoga County HOME and Affordable Housing Gap funding, Affordable Housing Program Grant funding through Federal Home Loan Bank of Boston, and seller financing.

The project is being co-developed by CHN Housing Partners (CHN) and Benjamin Rose, both organizations are headquartered in Cleveland, Ohio. Margaret Wagner Senior Apartments will provide much-needed senior affordable housing in a market where demand far outstrips supply.

For more than a century, Benjamin Rose has been providing care for Cuyahoga County’s senior population, and, in partnership with CHN, it will continue to manage the property and provide supportive services to its residents. A service coordinator will meet with each new tenant during orientation and offer to discuss the individual’s needs with emphasis on behavioral health, preferences for socialization activities, linkages to community-based partners, and primary health care providers when appropriate. Benjamin Rose has also coordinated with the City of Cleveland Heights Office of Aging to provide low-cost transportation for seniors within a 5-mile radius.

“Affordable housing development is never easy, but a strong development team allowed us to overcome the many challenges we faced while getting this project to the construction stage, and we are particularly grateful for KeyBank’s financial support,” said Mike Bier, Senior Project Manager for CHN Housing Partners. “The Margaret Wagner facility has a storied past in Cleveland Heights, and CHN is glad to be a part of its revitalization.”

“Since our founding in 1908, Benjamin Rose Institute on Aging has worked to ensure that older adults have a place to call home,” said Orion Bell, President and CEO, Benjamin Rose Institute on Aging. “Margaret Wagner House has been part of that legacy since 1960 and we are excited to see the property evolve to meet the changing needs of the people we serve and the neighborhoods in which they choose to live. We are grateful for KeyBank’s investment in this project and the community.”

“We are thrilled to be working with Benjamin Rose and CHN Housing Partners to provide affordable housing for our seniors,” said Derek Reed, Vice President, KeyBank CDLI. “KeyBank is committed to the communities we serve, and this investment is a key part of our efforts to build on the success of our National Community Benefits Plan.”

Derek Reed structured the tax credit equity investment and Tara Miller served as the Underwriter for the transaction.

Salem Manor

KeyBank Community Development Lending and Investment (CDLI) provided a $4 million construction loan and $6.3 million in Low-Income Housing Tax Credit (LIHTC) equity and arranged permanent financing with a $10.1 million Freddie Mac TEL for the acquisition and rehabilitation of Salem Manor, an existing family affordable housing project that was at risk of being converted to market rate housing in Salem, Oregon.

The project sponsor, Hampstead Development Partners, Inc., is an experienced developer focused on the development, acquisition and rehabilitation, and operation of affordable properties. KeyBank previously provided the acquisition bridge loan for resyndication for Hampstead to acquire and preserve this property.

Hampstead will immediately begin a $4 million rehabilitation of the property, which will include modernization of kitchens and bathrooms, full ADA accessibility upgrades to select units, upgrades to the buildings' electrical system to ensure tenant safety, the addition of a fitness cente,

The project offers 64 total units for families and individuals earning no more than 60% of the area median income (AMI) and is subsidized by a Section 8 Housing Assistant Payment (HAP) Contract. The 10-building property is located on the eastern side of the City of Salem in a mixed-use neighborhood with major shopping, schools, and recreational amenities located nearby.

John Paul Vachon, Matthew Haas, and Hector Zuniga of KeyBank CDLI structured the financing.

MidTown Collaboration Center

KeyBank Institutional Advisors and KeyBank Community Development Lending and Investment (CDLI) provided $30 million of financing to the Cleveland Foundation (TCF) for the construction of the 95,000-square-foot Midtown Collaboration Center (Center) located in Cleveland’s MidTown and historic Hough neighborhoods. The Center will be adjacent to TCF headquarters and aims to be both regionally significant and locally transformative.

KeyBank Institutional Advisors provided a $23.7 million loan to fund the new construction of the Center. Partners in this project include Case Western Reserve University (CWRU), University Hospitals (UH), the Cleveland Institute of Art (CIA), Hyland Software, and the Economic & Community Development Institute (ECDI), the country’s largest SBA micro lender.

KeyBank CDLI provided a $6.3 million equity investment in the New Market Tax Credits. The Center will house partners including CWRU’s new Center for Population Health Research, UH’s new Diabetes Research and Wellness Center, CIA’s new Interactive Media Lab, Hyland Software Training Center, JumpStart offices, ECDI – SBA Lending Center and Women’s Resource Center, and the Brewery/Taproom (BIPOC-owned) & community-led music venue.

The Center will bridge Cleveland’s downtown business center with its University Circle academic hub, bringing together multiple sectors and companies under one roof, to create a new model for a “both and” approach to economic activity that centers around community. The project builds upon the momentum of the adjacent Cleveland Foundation’s Headquarters project. Together, these two buildings represent the first of eight proposed structures in the planned 12-acre civic district.

“This project is part of the Cleveland Foundation’s overall mission of improving the quality of life in Cleveland neighborhoods and strengthening the fabric of our city as a whole,” said Cathy O’Malley Kearney, Head of Key Institutional Advisors. “We are proud to be a part of this important project which will provide a pathway to economic opportunity.”

“KeyBank is investing in this neighborhood with a commitment of capital for sustainable, inclusive, and equitable development,” said Ryan Olman, KeyBank CDLI. “We are pleased to partner with the Cleveland Foundation to transform and strengthen Cleveland’s neighborhoods and communities.”

“The MidTown Collaboration Center offers a new model for purpose-driven collaboration, equitable, community-centered development and partnership,” said Rosanne Potter, Cleveland Foundation Senior Vice President & Chief Financial Officer. “This project would not have been possible without KeyBank’s commitment to the Greater Cleveland community.”

Northfield Flats

Construction Loan, Perm Financing, LIHTC

CDLI provided $60.7 million of financing for the new construction of Northfield Flats, a 129-unit project in Denver that will consist of 42 one-bedroom, 83 two-bedroom, and four three-bedroom units. All units will be available for families earning no more than 30%, 50%, 60%, 70% and 80% of the AMI. Construction financing is being arranged by KeyBank with a $28.2 million construction loan and a $14.8 million permanent loan through the Fannie Mae MTEB Program. KeyBank is also providing $17.7 million of total tax credit equity. The project received local support with a $3.1 million Housing Trust Fund (HTF) loan from the Colorado Department of Local Affairs (CDOH) and a $4.5 million loan from Denver’s Department of Housing Stability (HOST).

Northfield Flats is conveniently located within the Northfield retail complex in Central Park, Denver’s premier mixed use master planned community. The property is located directly adjacent to the Shops at Northfield, a retail, entertainment, and dining center.

“KeyBank is invested in the expansion of its community impact, and we continue to provide more capital to low-income communities throughout the country,” said Victoria O’Brien, Head of Equity Originations at KeyBank CDLI. “As we further grow our platform in the Western region and collaborate with sponsors, we’re able to offer better affordable housing options to the individuals and families we serve.”

Brinshore Development, based in Chicago, is a national developer with a focus on development throughout the United States and has a current portfolio of 9,000 residential units valued at more than $1.3 billion in 100 communities. The second sponsor, Mile High Affordable Housing, is focused on affordable housing opportunities in Colorado, and has successfully developed eight affordable housing projects with more than 700 units.

Kortney Brown, Stephen Sparks and Robbie Lynn of KeyBank Community Lending and Investment structured the financing. Sam Adams of KeyBanc Capital Markets Public Finance Group provided the bond underwriting.

Ralston Gardens

Construction Loan, Perm Financing, LIHTC

CDLI provided $56.9 million of financing to fund the new construction of Ralston Gardens Apartments, a 102-unit family project in Arvada, Colorado, which will serve low-income families at 30%, 50%, 60%, and 70% of the Area Median Income (AMI). The building will contain 66 one-bedroom, 32 two-bedroom, and four three-bedroom units. Construction financing is being arranged by KeyBank with a $26.7 construction loan and a $14 million permanent loan through the Fannie Mae MTEB Program. KeyBank is also providing $16.2 million of total tax credit equity.

Ralston Garden Apartments, which is centrally located to transit hubs, shopping, parks, and local schools, received additional support and engagement from the Colorado Department of Local Affairs (CDOH), which provided a $4.3 million Housing Development Grant (HDG) loan.

“KeyBank is invested in the expansion of its community impact, and we continue to provide more capital to low-income communities throughout the country,” said Victoria O’Brien, Head of Equity Originations at KeyBank CDLI. “As we further grow our platform in the Western region and collaborate with sponsors, we’re able to offer better affordable housing options to the individuals and families we serve.”

Brinshore Development, based in Chicago, is a national developer with a focus on development throughout the United States and has a current portfolio of 9,000 residential units valued at more than $1.3 billion in 100 communities. The second sponsor, Mile High Affordable Housing, is focused on affordable housing opportunities in Colorado, and has successfully developed eight affordable housing projects with more than 700 units.

Kortney Brown, Stephen Sparks and Robbie Lynn of KeyBank Community Lending and Investment structured the financing. Sam Adams of KeyBanc Capital Markets Public Finance Group provided the bond underwriting.

Park Square II

Bridge to Resyndication Loan

KeyBank Community Development Lending and Investment provided financing for the acquisition of Park Square II, an existing 200-apartment affordable housing community in Rochester, NY. This community will serve low- to medium-income families at 50% to 80% of AMI (Area Median Income). We want to thank Conifer Realty for their sponsorship and shared mission to preserve much-needed affordable housing across the country.

The financing included a Bridge to Resyndication Loan of $13.23MM.

Hampton Point

KeyBank Community Development Lending & Investment provided financing for the tax credit resyndication of Hampton Point, a 284-unit, family affordable project in Punta Gorda, FL. All 284 units are set aside for individuals and families earning no more than 35%-60% of the Area Median Income (AMI), including seniors.

The garden-style community project houses 16 two- and three-story buildings, on extensive grounds of 48 acres. Planned rehabilitation includes the purchase and installation of solar panels which will greatly reduce the property’s electricity use. The tenant-in-place rehab will also provide updated buildings and interior units with competitive amenities including on-site management, a community room, playground, volleyball courts, fitness center, business center, and swimming pool.

We want to thank Lincoln Avenue Capital for their sponsorship and shared mission to preserve much-needed affordable housing in Punta Gorda, FL.

The financing included a $27.3MM HUD 223(f) Loan and $4.5MM HUD 241(a) Loan, $23.1MM of 4% federal low-income tax credit equity and solar tax credit equity, and a $15MM Equity Bridge Loan.

Grace Peck

Acquisition and Rehabilitation

KeyBank Community Development Lending and Investment (CDLI) announced that it is providing $67 million for the acquisition and rehabilitation of the Grace Peck Terrace Apartments in Portland, Oregon.

The senior housing community is being acquired by Home Forward, a public corporation that is the largest provider of affordable housing in the state, with its housing and programs serving approximately 15,500 households.

KeyBank’s CDLI group arranged a $27.2 million construction loan, a $21.3 million private-placement permanent loan, and low-income housing tax credit equity of $18.7 million. The project also received local support and engagement through the Oregon state housing tax credit and Section 8 project-based rental assistance.

Grace Peck Terrace consists of 95 one-bedroom units for individuals 62 and older or disabled persons earning no more than 60% of the area median income. The project will include a resident coordinator who will provide tenants with supportive services, including health and wellness check-ins and housing stability support, which will entail financial education, conflict resolution, social capital development, needs assessments, and surveys to determine resident requirements.

Through community partnerships, residents will also have access to on- and off-site services, such as emergency food assistance, nutrition and health education, home care services, case management, health services, nursing programs, and social isolation reduction services.

The above rate indications are for informational purposes only and are subject to change with market conditions. These rates are not firm bids or offers for any of these structures. The information is subject to change without notice. Your actual interest rate may differ based on creditworthiness, amount and other factors. All credit products are subject to collateral and/or credit approval, terms, conditions, and availability and subject to change. Key.com is a federally registered service mark of KeyCorp. ©2021 KeyCorp. KeyBank is Member FDIC.

Find an Expert

Our Expertise