Savings Account FAQs

Savings Account Basics

Yes. KeyBank savings accounts are FDIC-insured up to $250,000.

Annual Percentage Yield (APY) is the annual rate of return applied to your account. It takes into account the interest rate you're earning, plus any earned interest.

Interest is money earned at a particular rate indicated in the product disclosures.

Compound interest is the process of adding interest on the principal balance plus previously earned interest.

Savings Account Information

There are five ways to view your activity:

- In the monthly statement you opt to receive by mail or through email

- Sign on to online banking

- Use KeyBank’s mobile app (must be enrolled in online banking)

- Call 1-800-KEY2YOU® (1-800-539-2968)

- Visit a branch

There are two ways to add an authorized signer:

- Visit a branch

- Call 1-800-KEY2YOU® (1-800-539-2968) and follow the voice prompts. For clients using a TDD/TTY device, please call 1-800-539-8336.

Depending on the type of deposit you make at a KeyBank branch, ATM or on a mobile device, your funds may be available the next business day.

There are a few exceptions that may delay your funds’ availability, including deposits for a large dollar amount or to a KeyBank savings account that has been open less than 30 days.

When making a deposit, be sure you understand when your money will be available so that you can avoid overdrafts and fees. If you have any questions about your funds’ availability, talk to a KeyBank representative by phone or at one of our branches.

KeyBank uses state-of-the-art technology to ensure your personal and account information is kept safe. We deliver a secure environment through a variety of methods, such as encryption, firewalls and customer-controlled passwords.

Limited check writing is available with Key Silver Money Market Savings® and Key Gold Money Market Savings accounts.

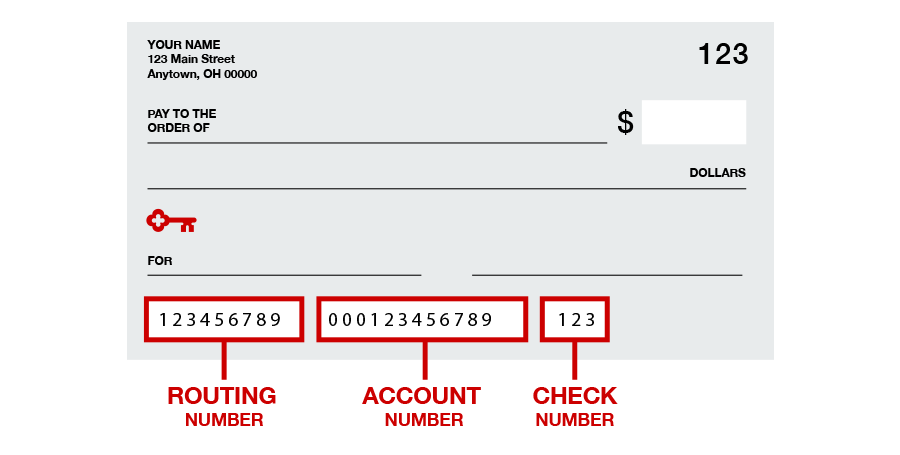

KeyBank makes it easy for you to order checks for your money market account.

To re-order checks:

- Place an order directly with Harland Clarke, KeyBank’s preferred check provider, or

- Visit a KeyBank branch near you, or

- Call 800-503-2345

For first-time check orders:

- Call 800-355-8123, or

- Visit a KeyBank branch near you.

Key Active Saver, Key Silver Money Market Savings®, and Key Gold Money Market Savings® accounts can be used to provide overdraft protection for checking accounts.

Federal law puts a limit of six transactions per month on certain transfers, withdrawals and payments from your savings or money market account.

The following types of transfers and withdrawals are limited to six per statement period:

- Online transfers from savings or money market accounts to another account

- Transfers made over the phone

- Automatic, preauthorized transfers, or recurring transfers like bill payments

- Overdraft transfers from your savings account to your checking account

- Transfers made by check or debit card

To help you avoid this fee, KeyBank will notify you when you reach six of these transactions within a statement period. However, beginning with the eighth qualifying transfer, withdrawal or payment during a statement period, KeyBank will assess a fee.

For each additional transfer, payment or withdrawal over the federal limit during a statement period, Key Active Saver accounts are charged $5.00, and Key Gold and Key Silver Money Market Savings accounts are charged $15.00.

For more information and to review all personal savings account fees and disclosures, check the Agreements and Disclosures.

There is no limit on the following types of transactions, and they don’t count toward the federal six-transaction limit. These include but are not limited to:

- Transactions made in person at a branch

- Money transferred into your account

- Money transferred between your accounts by mail, ATM or in a branch

- Money withdrawn from your account by mail, ATM or in a branch

- Overdraft transfers from your savings account to your checking account

It’s important that you have the right accounts for your needs. If you do find yourself going over the limit, consider speaking to a banker for a financial wellness review.